The economic business enterprise has exceeded through a enormous transformation in the past decade, with technology gambling a crucial function in reshaping traditional banking and monetary services. Behind this revolution are Finance Technology Engineers—the experts who layout, acquire, and preserve the digital infrastructure that powers modern-day-day finance. From on-line banking to cryptocurrency systems, those professionals make certain seamless and strong economic transactions.

In this blog, we are able to find out the duties, abilities, and future possibilities of finance era engineers and the way they contribute to the ever-evolving fintech panorama.

Who is a Finance Technology Engineer?

A Finance Technology Engineer (FinTech Engineer) is an IT expert focusing on economic structures, software program software, and infrastructure. Their function entails growing, optimizing, and securing economic programs, ensuring compliance with rules, and improving purchaser evaluations. They paintings in severa sectors, together with:

Banks and monetary establishments (virtual banking, charge processing)

Fintech startups (cellular wallets, robo-advisors)

Investment corporations (searching out and selling algorithms, portfolio control)

Insurance companies (automated underwriting, chance assessment)

Key Responsibilities of a Finance Technology Engineer

Finance Technology Engineers cope with severa crucial responsibilities, which encompass:

Developing Financial Software

Creating constant and inexperienced systems for online banking, seeking out and promoting, and payments.

Implementing AI-pushed fraud detection and hazard assessment equipment.

Managing Financial Data Security

Ensuring statistics encryption and cybersecurity measures to protect sensitive financial statistics.

Preventing cyber threats and monetary fraud using superior protection protocols.

Automating Financial Processes

Developing clever contracts and blockchain-primarily based solutions for apparent transactions.

Implementing system analyzing fashions for predictive analytics in finance.

Ensuring Compliance with Regulations

Working with economic regulators to fulfill compliance requirements like GDPR, PCI DSS, and KYC/AML.

Monitoring financial transactions for anti-coins laundering (AML) detection.

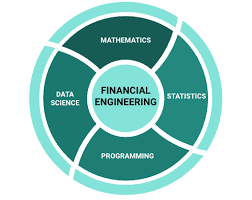

Skills Required to Become a Finance Technology Engineer

Finance Technology Engineers require a mixture of technical, analytical, and economic information. Some key capabilities encompass:

Programming and Software Development

Proficiency in Python, Java, C , and SQL for financial packages.

Experience in API improvement for banking and price integrations.

Cybersecurity and Data Protection

Knowledge of information encryption, firewalls, and fraud prevention techniques.

Ability to layout consistent digital rate solutions.

Financial Analytics and AI

Experience with huge records, AI, and tool analyzing for economic modeling.

Expertise in predictive analytics for hazard evaluation.

Blockchain and Cryptography

Understanding of blockchain technology and smart contracts.

Development of decentralized finance (DeFi) applications.

Financial Regulations and Compliance

Knowledge of global finance jail tips, risk manipulate, and regulatory frameworks.

Familiarity with monetary audits and reporting requirements.

The Future of Finance Technology Engineering

With rapid technological enhancements, the call for for Finance Technology Engineers is developing. Key inclinations shaping the destiny encompass:

Rise of AI in Finance: AI-powered chatbots, fraud detection, and robo-advisors are improving economic services.

Growth of Cryptocurrency and Blockchain: More agencies are adopting blockchain for strong, apparent transactions.

Open Banking and APIs: Banks are integrating 1/three-party financial services to enhance client opinions.

Increased Focus on Cybersecurity: As virtual transactions develop, sturdy safety skills are essential.

Conclusion

Finance Technology Engineers are on the coronary coronary heart of the fintech revolution, bridging the space among monetary services and present day technology. Their facts guarantees the seamless operation of banking, bills, and investment structures in an an increasing number of digital international. With financial era evolving abruptly, those specialists will preserve to play a vital characteristic in shaping the future of finance.